Yesterday on CNBC’s Futures Now program, Sven Henrich, or as you may know him on-the-line as The Northman Trader, offered some thoughts on the technical set up in the S&P 500 (SPX), watch here:

Regular readers are familiar with my view of the current economic backdrop and my belief that the conditions that made risk assets attractive to investors since the lows in early 2009 no longer exist. The volatility that has been prevalent in global risk assets since Q4 2014, when the U.S. Fed ended Quantitative Easing and was exacerbated by the Fed’s end of ZIRP in Q4 2015, will only continue as investors contemplate future rate hikes vs the possibility of U.S. sovereign debt to go below the zero interest bound as it has for nearly $9 trillion in sovereign debt around the globe.

This push and pull is unlikely to find easy resolution. And that’s why technical analysis is so useful for analyzing risk reward (and entry and exit points) in an environment where T.I.N.A (there is no alternative…to stocks) has become a universal rally cry. I’ll just leave you with the 5 year chart of the SPX. With the index still below the long term uptrend from the lows of the European Sovereign Debt Crisis, remember that in February it did something it has not done in the entire bull run from the 2009 lows… it made a new lower low:

The failure of the SPX to make a new high, even above the November highs (which was lower than the May 2015 all time highs) says to me that the path of least resistance is no longer higher.

[hr]

Northy was kind enough to share his fundamental observations that support his bearish technical views:

Risk Versus Reward

I was very vocal during the February lows liking the risk/reward for a long trade (Grand Designs): The rationale was purely technical in nature calling for a filling of the January gap and a reconnect with major long term moving averages.

Since these targets were subsequently met I have been very vocal about not liking the risk/reward to the long side.

Here’s why:

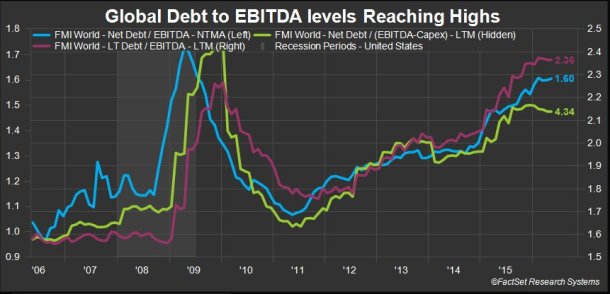

On the macro front, in aggregate, the S&P 500 shows little to no top line growth, its earnings have been declining for 4 quarters in a row, there is little productivity growth while companies are reducing their capital investment but keep loading up on debt. Corporate debt over EBTIDA is now back to 2008 highs after all:

In fact over the past year we have seen a marked decline in GAAP earnings with the end result that stocks are now much more expensive than they were last year:

Why pay almost 24 times GAAP earnings and 16.6 forward earnings with this backdrop? Because there is no alternative (TINA)? Hope? Yes maybe things will get better, but that’s a maybe and the evidence has yet to present itself. The middle class keeps shrinking and retail sales continue to be dearth and even “adjustments” can’t change that.

Something is going on with the consumer and the $SPX versus $XRT chart reflects that:

So in my mind stocks have 2 choices: Get less expensive via a sudden burst in earnings growth or get cheaper with a reset in asset values.

On the technical front:

Markets have gone really nowhere. We basically have remained in the same price range since QE3 has ended.

However, the S&P 500 is structurally at high risk of repeating a major topping pattern consistent with the year 2000 and 2007.

The 3 common elements of these topping patterns:

- Shrinking GAAP earnings

- Broken long term trend lines

- A crossover of the weekly 50 day moving average below the weekly 100 day moving average:

All of these conditions are in place now. This is a technical red flag.

The potential good news for bulls: Price is still above these moving averages so no real technical damage has yet occurred.

However should this price zone break down on a monthly basis (ie. by the end of May) then markets are looking to retest and possibly break the 2016 lows with technical targets of 1573 and 1486.

Now if GAAP earnings can break the trend and reverse higher then markets can break to new highs with technical targets of 2,334 and 2,458.

As of now I see little evidence of expanding earnings, rather I see emerging evidence of potential cost inflation as commodities have been rising and some wage growth is emerging.

And because of these data points the Fed is running out of excuses. If it wasn’t so scared of the market’s reaction it would have hiked again already, but because of the January/February correction it backed off. Still the Fed has to make a fundamental decision: Either it will have the ammunition to deal with the next crisis/recession or it won’t. And don’t think for a second NIRP/ZIRP, QE or any other central bank policy has magically eliminated the business cycle. It hasn’t.

And in an environment of little growth with creeping cost inflation employers will be forced to cut jobs and perhaps we are already seeing some evidence of this. The concern then is that the next crisis will have to be faced with more debt on the books and with central banks already all in. How well will the Fed be prepared to deal with it? Right now it can only bring back QE and take back one rate hike. It may need a lot more ammunition than that. And I suspect they know this and for this reason they may be forced to hike sooner than they want to. Not an easy decision to make.

We shall see and suspect this summer will provide clarity either way.

For further background articles please see: Market Analysis