Regular readers know I like to keep my macro commentary on the site short and sweet. That’s because it’s all one big mess and nearly impossible to synthesize into a cogent investment thesis. If the best and brightest central bankers, economists, strategists, analysts, investors and pundits barely know how their views will effect the price of risk assets it’s hard for a trader to tell how things will play out. But where I think I can add value is attempt to spot trends in sentiment before they become a mainstream theme, and call bullshit on conventional wisdom when it is needed.

This week’s MorningWord posts from Monday through Thursday have focused on China’s equity markets as they’ve captivated the investment with volatility and their government’s attempt to stabilize their markets. Here were my take-aways in a week that saw the Shanghai Composite sell off 15% from its Monday’s open and practically make back the entire losses on Thursday and Friday:

MorningWord 7/6/15: Bull in a China Shop

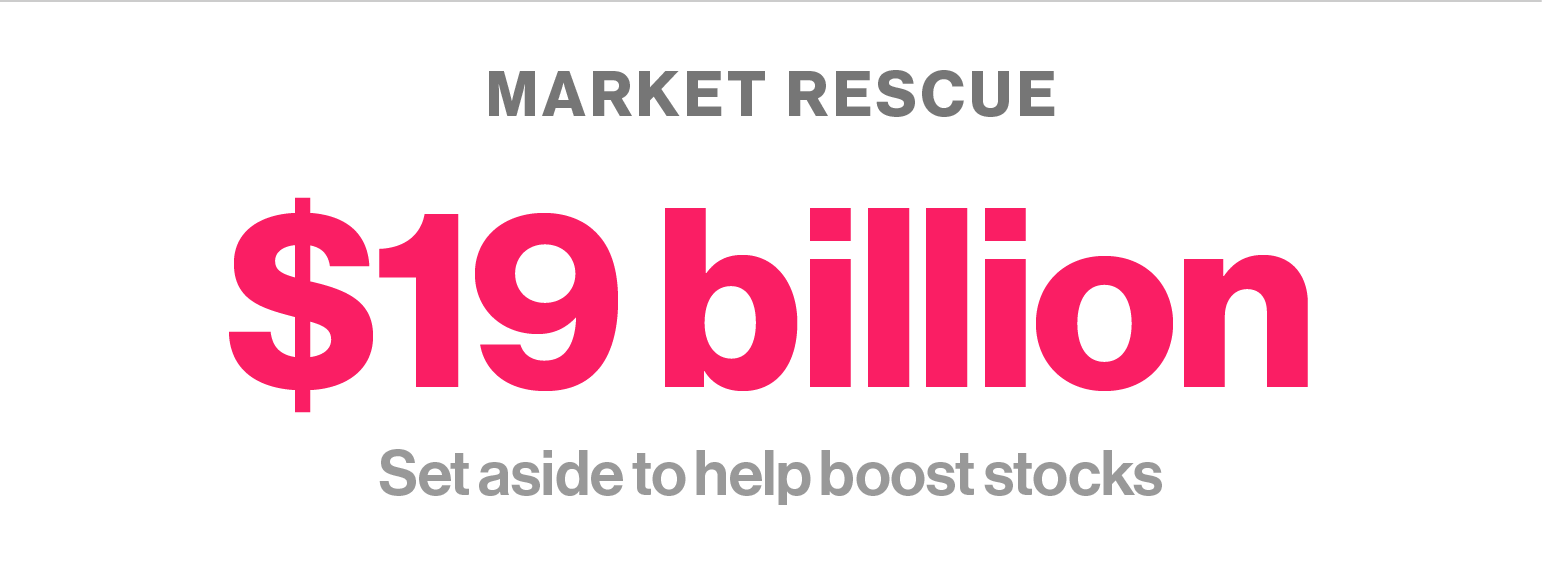

Over the next week the most important event may be that the Shanghai Comp holds at support. The announcement that Chinese brokerages and fund managers established a $19.3 billion stabilization fund is a bit of a joke when you consider they are attempting to stem $3 trillion in losses over the last month.

Make no mistake, it was a full on mania over there in the stock market, and there will be fits and starts with violent counter-trend rallies. And depending on how serious the government is in propping the markets, maybe a new high. It is important to note that despite the Shanghai Comp’s nearly 30% declines from the June highs, it is still up 85% from its 52 week lows, so once it breaks support, I suspect it will overshoot on the downside as it did on the upside.

MorningWord 7/7/15: The China Syndrome

It is possible that the financial press and pundits are making too big a deal of the volatility. There will be sharp counter trend rallies, of course. And it is possible that the stabilization efforts succeed and the bubble is partially re-inflated. So for those who are nimble and like to trade, and employ disciplined risk management, there could be fortunes made (and lost) trading Chinese equities. But for those looking for investment opportunities, there is very little that is sound right now in China’s opaque markets.

MorningWord 7/8/15: Volatile Compounds

Our equity markets don’t appear to be too bothered by the volatility in China and the uncertainty surrounding Greece as the S&P500 is just a touch above the unchanged point for the year and just 2.5% off the all time highs made in May. Since the collapse of Oil that started a little more than a year ago, we have been vocal about the strong likelihood that extreme volatility in commodities, currencies, bonds and global stock markets will at some point find its way into U.S. stocks, but it hasn’t yet. The relative strength in the U.S. stock market, treasuries and the dollar make sense as a sort of flight to quality, but Monday’s move in oil (down nearly 8%), gold’s inability to rally, and Chinese stocks disregarding unprecedented stabilization methods suggests to me that things are starting to get unhinged, despite the backdrop of complacent U.S. investors.

……

As someone who was a very active trader in the aftermath of the dotcom burst in the early 2000s, and the financial crisis later in the decade, I can tell you that sort of price action is far from bullish. Counter trend rallies can be fierce, and challenge your conviction, but just as you bought the dips in during the QE fueled rally, it could be time sell the rips as global markets come to grips with the post FOMC world.

MorningWord 7/9/15: Chinese Stock Rally Was Born Into A Grave

Counter trend rallies will be violent, and there are sure to be many of them, but make no mistake, this Chinese equity bubble was born into a grave. As I have been saying for a couple weeks, I suspect the Shanghai Comp will overshoot on the downside, just as it did on the upside, and before its all said and done will likely round-trip at least back to the 2500 breakout level from late November. For those that are nimble and can employ disciplined risk management there will be no shortage of trading opportunities, I will likely focus on shorting rallies, and I certainly don’t expect the trading on either side to be easy

So where I am I now? after a week of this in the Shanghai Comp:

And this is the S&P 500 futures over the last 6 trading days:

While our markets have been volatile day to day, they basically ended up trading sideways, with just a little more than a 2% range over the past week, and I suspect with this morning’s 1.35% gap that we are likely to close within the weekly range.

So our markets were not particularly bothered as much as they were day trading off the latest headlines. With Chinese stocks now rallying the past 2 days and the world a bit more comfortable about some sort of can-kicking agreement in Greece, we are going to test technical resistance in the SPX. The first spot where we could pause is 2100, which coincides with the index’s 50 day moving average (purple line below). For the first time in a long time that 50 day average is declining. And if the market gets above the 50 day then of course the prior all time high from May at 2140 becomes the target:

As for the Shanghai Comp, I’ll stick with my view from the start of the week, it needs to hold 3400, which it did like a BOSS:

A short of the Shanghai when this rally appears to be faltering, playing for a break of 3400 could be the trade of the year, cause when it breaks the next time, after all the crap the government has pulled, it ain’t gonna be pretty.

Oh and if you had any doubt that the stock market is an uncontrollable mania in China, check out these stats compiled by Bloomberg

By any standard, the selloff in Chinese stocks over the past month has been epic.

Here’s a look at the turmoil by numbers.

The Shanghai Stock Exchange Composite Index has lost 28 percent since its peak on June 12, the worst selloff in two decades. About $3.9 trillion in market valuation has evaporated, more than the total annual output of Germany—the world’s fourth-largest economy—and 16 times Greece’s gross domestic product. The benchmark is still up 82 percent in the past year, the most among the world’s major markets.

As shares tumbled, companies rushed to apply for trading suspension. More than 1,400 companies stopped trading on mainland exchanges, locking sellers out of 50 percent of the market. The China Securities Regulatory Commission also banned major shareholders, corporate executives, and directors from selling stakes in listed companies for six months.

Chinese stocks have become the most volatile among major markets after Greece. A measure of 30-day price swings on the Shanghai benchmark reached 56, the highest since 2008. The volatility is more than five times that of the Standard & Poor’s 500-stock index.

Investors who borrow money from brokerages have amplified the boom-and-bust. A fivefold surge in margin debt helped propel the Shanghai index up more than 150 percent in the 12 months through June 12. On the way down, leveraged investors unwoundtheir holdings to repay the loans, amplifying the crash. While margin debt on the exchanges has declined by 823 billion yuan ($133 billion) since the mid-June peak, to 1.44 trillion yuan, it’s still more than triple the level from a year earlier.

Officials have unveiled market-boosting measures almost every night in the past two weeks. A group of 21 brokerages has pledged to invest at least 120 billion yuan in a stock market fund, taking a page from the playbook used by J.P. Morgan and Guaranty Trust Co. during the 1929 U.S. crash. Regulators have banned major stockholders from selling stakes in listed companies, suspended initial public offerings, and restricted short selling.

While the efforts have helped boost the largest stated-owned companies—oil giant PetroChina has gained 22 percent since June 26—they have so far failed to revive overseas investors’ confidence. Dual-listed Chinese stocks traded 33 percent lower in Hong Kong than on the mainland, the biggest discount since 2009, suggesting investors abroad are more pessimistic than the locals on the valuation of the companies.

Additional losses threaten to drag down further the slowest economic growth since 1990 and stir social discontent. The world’s second-largest equity market now has more than 90 million individual investors, which is higher than the number of Communist Party members.