MorningWord 7/9/13: Get ready, because I have a little rant coming your way. Not because I have been wrong on the direction of the SPX since the bounce off of the June 24th intermediate term lows (although I did anticipate a re-test of 1620), but more because of the reasons why we are flirting once again with the previous highs. Equity investors in the last 4 years, particularly since the start of QE in 2010 have gotten very familiar with the notion that markets climb walls of worry. If you faded every gloom and doom call and bought every 5% dip then you traded/invested like a pure maestro, and you likely regained all that was lost in the market crash of 2008/09. I have said it before in this space and I will say it again, it is in everyone & most everything’s (you, your broker, your pension fund, your mutual fund, your house, your elected officials, your blood pressure’s) best interest that assets perpetually go up. When they don’t go up, the powers that be start the juicing, no matter what the cause of the descent. Starting the juicing is the easy part, it’s the weaning off the juice that is the hard part. Just ask Barry Bonds, Jose Canseco, A-Rod or Lance Armstrong. They won all the accolades while they were under the influence and saw their lives fall to pieces once clean. U.S. equities up nearly 50% since the start of QE back in 2010 have enjoyed one heck of a ride, showing dramatic relative strength to almost every other major index in the developed world, toppling milestone after milestone, but what comes next?

Which leads me to the impending detox as the Fed prepares to Taper QE. As we head into Q2 earnings season, we are starting to see a lot of handicapping of investor expectations for corporate earnings in the period just ended. Yesterday in this space (here) I quickly touched upon what Q2 earnings season has in store, despite revenue growth that is expected to be flat over the first half, second half 2013 earnings are expected to grow due to well, margin expansion. Miraculously with the turn of the page into July, the “second half story” is in full effect, as U.S. companies are going to start squeezing out more profit from consumers like you and me, or firing more of you and me to lower their costs, or invest less in research and development at the cost of innovation… all for the sake of margin expansion in an effort to hit those lofty forward expectations.

Last week on July 2nd, Barron’s Online previewed Q2 earnings in a piece titled, Low Expectations, High Hopes, where they quoted Citi Strategist Tobias Levkovich:

“Right now, the Street sees double-digit earnings growth in the second half of 2013 and double-digit growth in 2014,” Levkovich says. “But that requires a strong U.S. and that Europe gets out of its funk, which I am not optimistic of happening quickly given credit conditions. And finally, emerging markets — especially commodity-based economies — such as Peru, Chile, Brazil — will be weaker.” That makes the consensus forecasts of 11% gains for the second half “optimistic,” he concludes.

Consensus estimates call for the Standard & Poor’s 500 companies to report aggregate earnings per share for the second quarter just a few pennies below the first quarter’s $26.71, but then accelerate markedly, to $27.72 in the third quarter and $29.32 in the fourth, according to figures from S&P Capital IQ. For the full year, estimates are for $110, a 6.3% gain over 2012. Wall Street is looking for a hefty 11.4% surge to $122.25 in 2014.

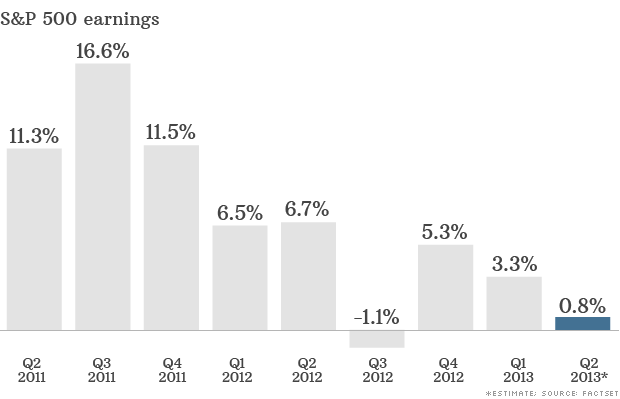

On a similar but different note, yesterday Josh Brown, author of the Reformed Broker Blog had a nice chart of the last 2 years quarterly S&P earnings growth via CNNMoney (below) and Q2 2013 which analysts expect to grow less than 1% year over year, a dramatic sequential deceleration. Josh’s point is that expectations are not high for Q2 and he thinks that is a huge potential positive as we head into Q2 earnings season. Basically, the potential for upside surprises of already lowered guidance.

While I find it hard to disagree with Josh as it relates to Q2, I believe the weakness is already “baked into the cake” so to speak, and I would suggest that a downbeat Q3 outlook with limited visibility may not be received well with stocks less than 2.5% off of the all time highs made in May. As we have mentioned on numerous occasions of late, U.S. multi-nationals receive at least half of their sales from overseas, not to mention much of their future growth. The potential for a hard landing in China, weakening global demand from emerging markets, surging dollar and rising bond yields could cause severe headwinds for the crowded U.S. equity trade, at a time the Fed prepares to reduce its rate of Quantitative Easing.

Now I am no economist but that seems like a nasty cocktail of headwinds and I didn’t even mention the word Europe, riots in Brazil and Turkey, and what appears to be an impending civil war in Egypt. But the fact of the matter, and despite the geo-political concerns, that markets frankly don’t seemed concerned about, crude oil recently topped $100 a barrel, despite weak global demand and rising inventories… oops.

So where am I going with this? The U.S. economy is the least of our concerns. As noted Bull, Ed Yardeni of Yardeni Research stated in the above referenced Barron’s article,

“The major challenge this year and next is the global economy,” “We’ve learned economies can’t decouple from each other in a meaningful fashion.”

And there it is, the Ol’ Decoupling Myth. Back in the Financial Crisis of 2008/09, it was initially thought of as the U.S. financial crisis. until it spread to Europe and then Asia and eventually engulfed the entire planet. The global economy is forever linked from here on out, and if China’s GDP is really going below 7% (possibly 6%) this year or early next, while our GDP is fighting to get above 2% in the 4th year of a recovery after trillions of dollars of stimulus at a time when the Fed is likely to pull back, the likelihood of this thing ending well in the near term ain’t exactly great.

But have a ball, buy every dip, especially if you believe in fairy tales like “decoupling.” All I know is that I heard that story in 2000 prior to what amounted to a debilitating protracted 3 year bear market and recession and then again in 2008/09, both periods that saw peak to trough draw-downs in the SPX of over 50%.

I hate equities here, but I am long them, always, just like you. Mostly in mutual funds, in retirement accounts, a few special individual ones that hold a little place in my heart for the kids college fund, or my retirement. But to not reduce exposures to equities in the face of such uncertainty, after a short but fairly unprecedented period of volatility in bonds, currencies and commodities, with the SPX 2.5% from all time highs just seems a bit reckless to me. I am not a financial adviser, and frankly I don’t make my living from writing on this website, so I frankly don’t really have anything to sell you that changes my life one way or the other, aside from an alternative perspective to what seems to dominate financial punditry, the overriding desire to collude on one simple premise, keep the investing public optimistic. That’s not my game, if you want that, click on another financial blog, or lower the volume when you see my mug on TV. Sorry, I can only call them the way I see them, and frankly I am a bit sick of the simple collusion that to make money in equities you just need to always buy whether they are up or down.

A few weeks back I said on Fast Money and in this space that I was fairly certain we were entering a topping phase, and I stick by that notion, will Q2 earnings prove me wrong? I don’t think so, but if we make a new high despite what is likely a downbeat Q3 outlook, maybe all bets are off, but I sure as shit don’t want be buying them there either.