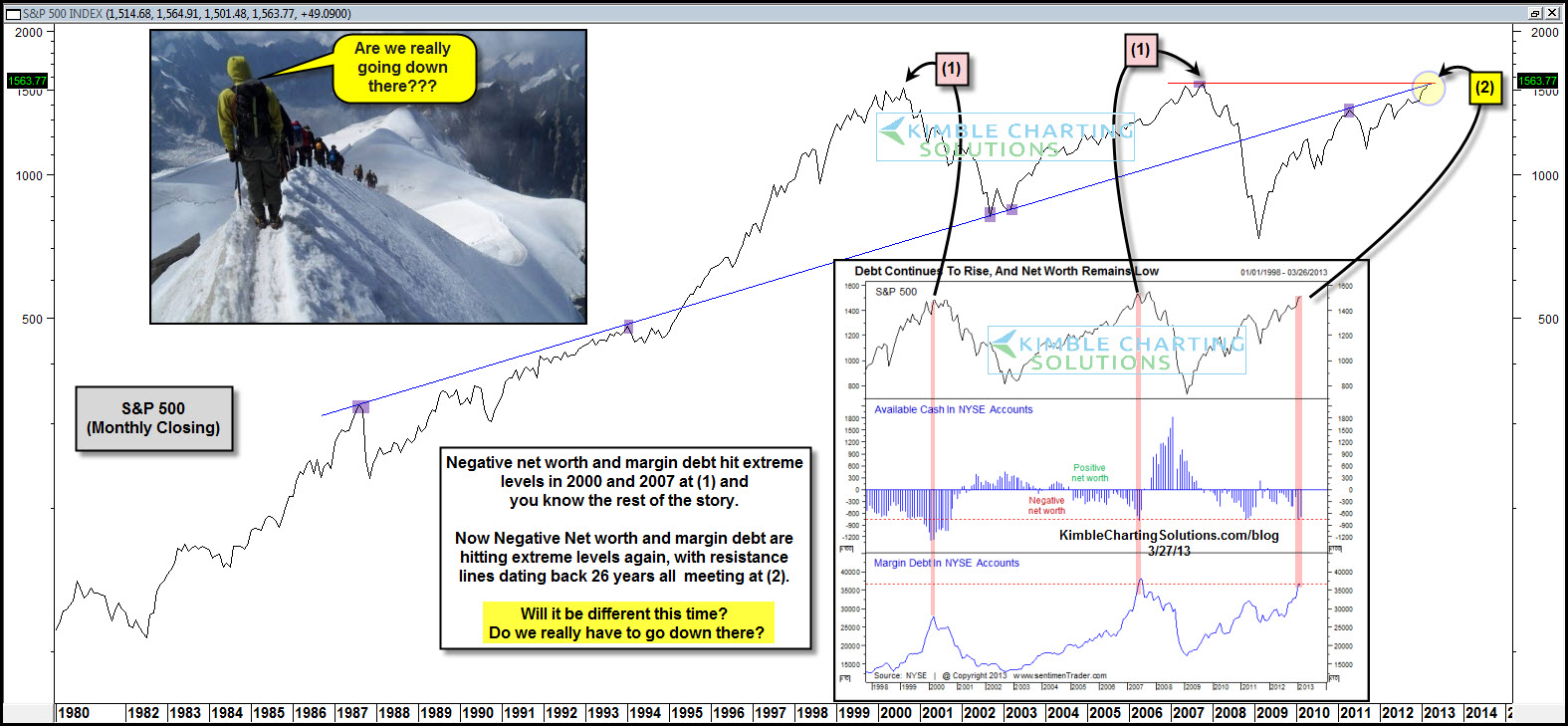

A chart making the active rounds in the blogosphere for the past month is an illustration of margin debt on the NYSE nearing the July 2007 record. The first time I saw it was about a month ago on Josh Brown’s site, where he cited Chris Kimble of Kimble Charting Solutions:

Chris Kimble at Kimble Charting Solutions shows us the S&P 500 versus NYSE cash available in brokerage accounts as well as an overlay of the margin debt chart. All measures are at extremes not seen since the prior to market peaks of 2000 and 2007.

Will history repeat?

Click to Embiggen:

Source:

Andrew Kassen of SeeItMarket delved deeper into the historical context of excessive margin debt in a good post yesterday:

Comparing March 2013 to July 2007, you can see a nominal record high in margin debt is a small step away.

Comparing these values and dates evokes mild alarm and some pressing questions: is margin debt a leading indicator of major market turning points? Is this $350B+ a kind of “irrational exuberance” line-in-the-sand where the animal spirits that have been driving margin borrowing up and stock indices higher begins to cannibalize themselves and ultimately subvert the bull market they’ve created? What’s to prevent margin debt from rising higher? And does attainment of record levels have to mean a violent downturn, or we see margin debt moderate over time unaccompanied by a major bear market? Is margin debt telling investors to expect something like late 2007 (and after) in the near-term?

As a partial answer, there is an indisputable positive correlation between the growth and contraction of margin debt and broad-based market performance: as you might expect, the value of stocks held and the amount borrowed to hold them necessarily goes up and down as the market does. But whether margin debt’s a) rate of growth and/or b) absolute level has a causal link to market tops and bottoms is more controversial and difficult to demonstrate.

…

Looking beyond raw margin debt, this net worth figure far exceeds the June 2007 high of -79B. However, it isn’t a record. As the following chart published in March (pulling from January 2013′s figures) by Doug Short shows, at its height the Dot-Com Bubble featured aggregate negative net worth exceeding -$100B for multiple months (click image to zoom):

So it’s not a record. But keep in mind: early 2000′s aggregate net worth figures are what drove the NASDAQ to 5132, a speculative peak from to which it is only beginning to appreciably recover 13 years later. Perhaps 2007′s net worth figures are more instructive: but if so, that lends little comfort. Negative net money doesn’t necessarily indicates a market top; but negative net money blowoffs (February 2000, June 2007, even Spring 2011) do appear to precede market tops. Are we witnessing just such an occurrence right now? With the impact of inflation, market cap growth and the not-so-invisible hand of the Fed the picture has never been muddier. Let’s just say the “excessive” conditions that prevailed in pre-QE world are here once again. The environment is different; but history may rhyme, despite those forces arrayed against that outcome.

Andrew’s takeaway is my main takeaway as well. High margin debt on its own does not mean a certain top has arrived. But it certainly signals a more vulnerable market backdrop, where any sustained selling can quickly turn into a mini-rout as margin clerks start making calls to traders to shore up deficient accounts.

In that sense, high margin debt provides another reason why implied volatility is likely priced too cheaply, all things considered. Options protection should be more expensive when more and more traders are leveraged long. My key takeaway from near-record margin debt – volatility is likely headed higher in the coming months, whether stocks go up or down. So options sellers, not stock buyers, are the most complacent crowd right now.