As I highlighted this morning in my GOOG 4th quarter preview, their main problem in the past year has been its deteriorating margins. Sales have actually grown more than 40% from 2011 to 2012 (the best performance in the past 5 years), but earnings only grew 11% (the worst performance in the past 5 years).

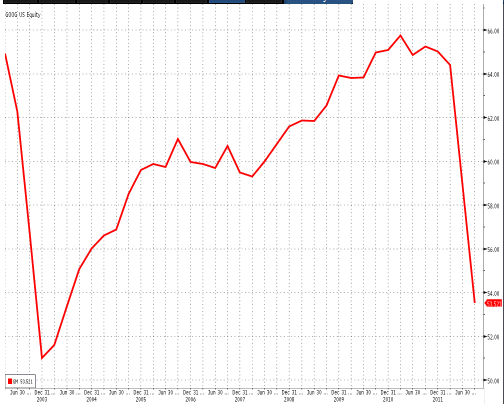

Here is a chart of gross margins for GOOG over the last 10 years, courtesy of Bloomberg:

The real question for 2013 is whether GOOG is able to stabilize its gross margins after a precipitous fall in the last year.

Goldman Sachs highlighted the same issue in its GOOG preview:

While we expect a solid quarter from Google, with net revenue in line if not slightly above consensus, due to slightly better than expected CPCs versus the Street we continue to see a future where operating margins will be under pressure. We note that sales for the Nexus 4, Nexus 7 and Nexus 10, which we estimate the company sells at cost, will be recorded in the Licensing and other revenues segment line. Our view on margins is based on an increasing percentage of mobile queries as well as what we expect will be a more integrated hardware/software design strategy leveraging MMI in 2013

GOOG still has envious sales growth projected for the next 2 years. But many of GOOG’s new initiatives are sales drivers, but earnings laggards, ending up as a net drag on the company’s main advertising business. Watch the margins story to see if that trend is likely to continue into 2013.