I have traded options professionally for many, many years, and the action in the VIX in the past 2 weeks is truly rare. Here is last week’s snapshot:

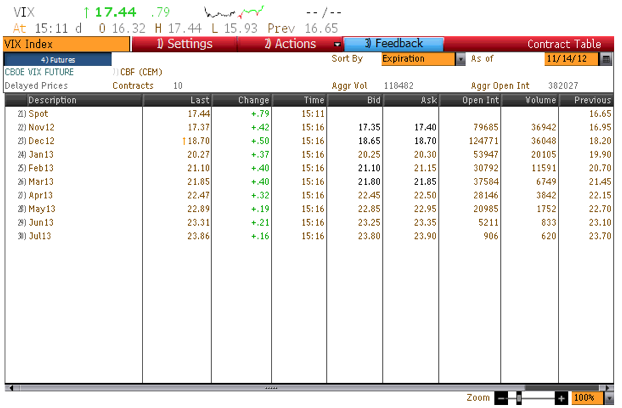

And today:

I wrote last week that I thought Vol was too low. Incredibly, the market is down almost an incremental 3% from last Wednesday, but VIX futures are actually lower to flat at almost every maturity. I can understand the argument that since we are approaching the holiday season, traders don’t want to own options. But at these levels? Protection seems way too cheap.

I’m still long the Nov VIX 20 / 25 call spread that I traded last week, so you can accuse me of talking my book. But forget November. Even the fact that March or April 2013 VIX futures are flat with the market down 3% in the last week is a very rare occurrence.

Traders have clearly given up betting on increased volatility after getting burned this year on that trade. But the fact that they’re throwing in the towel even as volatility picks up makes me think that 2013 is going to be a year of very large volatility.