Companies added 162,000 jobs in September, more than economists expected but still pointing to slow improvement in the labor market, data from a payrolls processor showed on Wednesday.

Economists surveyed by Reuters had forecast the ADP National Employment Report would show a gain of 143,000 jobs.

The increase in private payrolls in August was revised down to 189,000 from the previously reported 201,000. July’s rise was also revised down, to 156,000 from 173,000.

Stocks and commodities are slightly softer as investors express wariness over global growth prospects following weak data from Europe, China and Australia.

The FTSE All-World equity index is down 0.1 per cent as the FTSE Eurofirst 300 sees a loss of 0.2 per cent and after the Asia-Pacific region shed 0.3 per cent.

US futures suggest Wall Street’s S&P 500 will add 0.1 per cent when the starting bell rings later in the session. Gold is up $5 to $1,779 an ounce, even as the US dollar index, with which it tends to be inversely correlated, gains 0.1 per cent.

Trading matches the somewhat muddled and twitchy characteristics seen over the first few sessions of the fourth quarter. Bulls have struggled to reassert their dominance and continue the “risk asset” rally of the previous four months, which came on the back of concerted central bank action to bolster growth and tackle eurozone sovereign debt stress.

The Refinance Index increased 20 percent from the previous week. This was the highest Refinance Index recorded in the survey since April of 2009. The seasonally adjusted Purchase Index increased 4 percent from one week earlier.

“Refinance application volume jumped to the highest level in more than three years last week as each of the five mortgage rates in MBA’s survey dropped to new record lows in the survey,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Financial markets continue to adjust to QE3, as the ongoing presence of the Federal Reserve as a significant buyer of mortgage-backed securities applies downward pressure on rates.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.53 percentfrom 3.63 percent, with points decreasing to 0.35 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

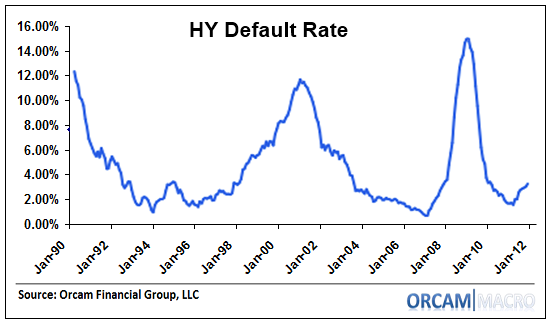

Here’s an interesting downgrade from Morgan Stanley that carries some macro relevance. They’ve downgraded their view on high yield

credit due to some “cracks in the fundamentals”. They’re not sounding the alarms at this point, but they say HY credit is now priced richly. We saw similar commentary the other day in IG corporates. The creeping high yield default rate is usually consistent with deteriorating fundamental so MS’s downgrade is worthy of attention here. More from Morgan Stanley:

“Our credit downgrade is not purely a valuation call. For the first time in a few years we are seeing weakness in the macro data filter through to high yield

fundamentals.

To be clear, the starting point matters, and balance sheets are still very healthy in aggregate. Nevertheless, some of the fundamental tailwinds that have supported high yield credit over the past few years seem to

be abating. For example, leverage is now ticking higher for the median high yield company for two separate reasons. 1) Many high quality companies are incentivized to issue debt given record low yields; and 2) About 34% of the HY market actually had negative YoY LTM EBITDA growth in 2Q12, because of the weak growth backdrop mentioned above.In addition, we are also seeing a pickup in idiosyncratic situations and weakness in certain economically sensitive sectors, due to slower global growth (the Metals/Mining HY sub-index is up 5.3% YTD, vs. 12.4% for the broader index). Lastly, defaults are creeping higher, up from the lows of 1.9% in Dec 2011 to 3.5% today. In general, we think default risk is still low over the next year or so given factors such as the health of corporate balance sheets, and backdated maturity schedules. But if economic growth does not pick up, defaults may continue to trend towards the longterm average of 4.8%, another modest headwind, especially

given current valuations.”

MetroPCS [PCS 13.57

] – A German newspaper reported that the company’s board has approved a deal to merge with Deutsche Telekom’s T-Mobile unit. The two sides had acknowledged Tuesday that they were in talksabout such a deal.

Family Dollar [FDO 66.00

] – The retailer earned $0.75 per share for its fourth quarter, excluding certain items, matching Street estimates. Revenue was in line with forecasts, though continued pressure on profit margins could weigh on the stock.

Best Buy [BBY 16.97

] – Founder Richard Schulze and at least four private-equity firms are examining the electronics retailer’s books, according to Reuters. Sources said these early steps could lead to a buyout worth as much as $11 billion.

Oracle [ORCL 31.65

] – In a wide ranging interview on CNBC’s “Closing Bell” late Tuesday, CEO Larry Ellison said the company is not planning any major acquisitions, and that Oracle has all the assets in house that it needs to grow rapidly. (Read More: So Why Does Ellison Need a $4 Billion Line of Credit?)

InterMune [ITMN 8.85

] – Canadian regulators have approved the biotech company’s drug Espriet for use in trading idiopathic pulmonary fibrosis. The drug is now approved for use in 29 European countries, Japan, and South Korea, and the company continues its efforts to have the drug approved in the U.S. following a May 2010 rejection.

Microsoft [MSFT 29.66

] – The software giant’s stock got a positive mention at Bernstein, which says there are a number of factors that could drive revenue higher than currently forecast.

Ford Motor [F 9.79

], General Motors [GM 23.68

] – The U.S. auto industry’s annual sales rate for September totaled 14.94 million units, up from 13.14 million a year earlier and the highest monthly rate since March 2008. (Read More: September Sales Show Toyota Nipping at Ford’s Heels.)

AutoNation [AN 44.55 — UNCH

] – The auto retailer said new car sales were up 23 percent in September compared to a year earlier, and up 22 percent for the third quarter.

Vivus [VVUS 18.38

] – The drug company has won the dismissal of a securities class action lawsuit that had been filed in November 2010.

Nokia [NOK 2.62

] – The handset maker is considering selling its Finland headquarters to raise cash, although it said it has no plans to move.