U.S. home prices shot up in April to post the first monthly gain since last autumn, according to a closely followed index released Tuesday.

The S&P/Case-Shiller 20-city composite index gained 1.3%, with 19 out of 20 cities registering gains, to take the year-on-year drop from 2.6% to 1.9%.

Of the 20 cities measured, only hard-hit Detroit took a step backward, with a 3.6% reversal. Even Atlanta, where prices were 17% below year-ago levels, enjoyed a 2.3% monthly gain.

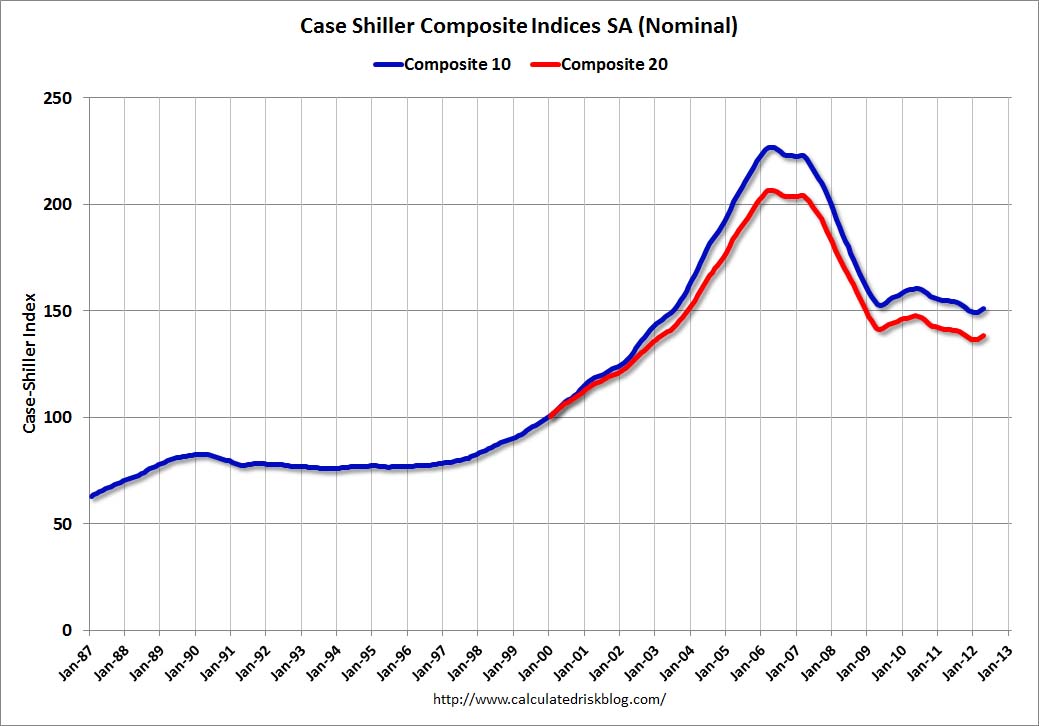

S&P/Case-Shiller released the monthly Home Price Indices for April (a 3 month average of February, March and April).

This release includes prices for 20 individual cities and two composite indices (for 10 cities and 20 cities).

The Composite 10 index is off 33.3% from the peak, and up 0.7% in April (SA). The Composite 10 is up from the post bubble low set in March, Not Seasonally Adjusted (NSA).

The Composite 20 index is off 33.0% from the peak, and up 0.7% (SA) in April. The Composite 20 is also up from the post-bubble low set in March (NSA).

The S&P is now up 4.46% for 2012, which is 7.42% off the interim closing high of April 2nd.

From an intermediate perspective, the S&P 500 is 94.2% above the March 2009 closing low and 16.1% below the nominal all-time high of October 2007.

Apollo’s fiscal third-quarter earnings fell 37% as the for-profit education company’s revenue continued to slip and enrollment dropped. However, shares jumped as results topped analyst expectations. The stock was last up 3.2% to $33.50 in premarket trading.

Coinstar lowered its earnings outlook for the year after closing its $100 million purchase of NCR Corp.’s (NCR) DVD-kiosk business Monday. Shares were down 4.3% to $62.61 premarket on the softer forecast.

News Corp. is considering splitting into two companies, separating its publishing assets from its entertainment businesses, people familiar with the situation have told The Wall Street Journal. News Corp. owns Dow Jones & Co., publisher of this newswire and The Wall Street Journal. Class A shares were last trading 5.7% higher at $21.23 in premarket trade.

Seagate Technology Inc. (STX) will replace Progress Energy Inc. (PGN) in the S&P 500 index after the close of trading on Friday, due to Duke Energy Corp.’s (DUK) planned acquisition of Progress. Seagate shares were last trading 4% higher premarket at $24.20.

LDK Solar Co. (LDK) swung to a worse-than-expected fiscal first-quarter loss as the solar-product maker continued to battle industry-wide oversupply and price declines. The company also forecast second-quarter revenue below expectations and trimmed its full-year targets. Shares slumped 7.4% to $1.87 in premarket trading.

Shares of drug maker Supernus Pharmaceuticals Inc. (SUPN) surged Tuesday after the company said it has received tentative approval of its epilepsy drug Trokendi from the Food & Drug Administration. Shares were last up 37% to $7.80 in premarket trade.

Rosetta Genomics Ltd. (ROSG) plans to offer up to $35 million in ordinary shares as the molecular-diagnostics firm looks to raise money for its operations and other purposes. Shares slid 8.1% to $10.80 premarket.