Next Week’s Tape: Early Peek at September Data

Next week’s tape is fairly heavily loaded on the back end, with some early readings on how well/terribly things are going in September.

Economics:

Monday

Dallas Fed President Richard Fisher Speaks

St. Louis Fed President James Bullard Speaks

3-Year Treasury Note Auction

Tuesday

Export and Import Prices

10-Year Treasury Note Auction

Wednesday

PPI

Retail Sales

Business Inventories

30-Year Treasury Note Auction

Thursday

Jobless Claims

CPI

Empire State Manufacturing

Industrial Production & Capacity Utilization

Philly Fed

Ben Bernanke Speaks

Friday

University of Michigan Consumer Sentiment

Fears about Europe’s deteriorating finances intensified on Sunday as new doubts about the health of French banks, as well as Germany’s willingness to help Greece avert default, left investors bracing for another global stock market downturn this week.

Group of 8 leaders met on Friday in Marseille, including the French finance minister, Francois Baroin, center.

Wolfgang Schäuble, right, the German finance minister, and Jens Weidmann, president of Germany’s central bank.

In Greece, the epicenter of the Continent’s financial disarray, government officials announced new austerity measures on Sunday, even as the country’s finance minister, Evangelos Venizelos, warned that the Greek economy was expected to shrink much more sharply this year than previously anticipated. In a revision, a contraction of 5.3 percent in 2011 was predicted, rather than the 3.8 percent forecast in May.

Slower growth could make it harder for Greece to pay its debts, even as it tries to reduce them by cutting government spending and raising taxes.

While the Greek drama has been running for more than a year, only recently has it threatened French and German banks, unnerving investors around the world and sending stocks tumbling in Europe and the United States.

More than anything else, political and business leaders want to avoid the phenomenon of contagion, in which fears in one country spread to others, causing severe stress throughout the financial system, as happened in the fall of 2008. To be sure, Europe could still draw away from the precipice. That is especially true if policy makers come up with a plan to keep Greece afloat while also preventing anxiety from infecting other countries like Spain and Italy, whose huge debts and weak economies have fed worries that their borrowing has become unsustainable.

On Sunday, French government officials braced for possible ratings downgrades by Moody’s Investors Service of France’s three largest banks, BNP Paribas, Société Générale and Crédit Agricole, whose shares were among the biggest losers last week. The biggest banks in Europe, especially in France, hold billions of euros’ worth of Greek bonds, and investors fear even a partial default by Greece would sharply diminish the value of those assets, eroding already weak capital positions.

American financial institutions, typically heavy lenders to their French counterparts, have begun to pull back on these loans, but United States banks’ exposure to France remains substantial.

Investors are valuing European banks at levels not seen since the depths of the credit crunch that followed the collapse of Lehman Brothers Holdings Inc. (LEHMQ) as concern over a Greek default and debt contagion escalates.

A Bloomberg index shows 46 lenders trading at 0.58 times book value, the cheapest since the post-Lehman lows of March 2009, signaling investors estimate their assets are worth just over half what the companies claim. Valuations reflect the impact of a potential sovereign default for some banks, according to Barclays Capital analysts led by Jeremy Sigee.

Group of Seven finance chiefs meeting in Marseille, France, over the weekend vowed to support banks amid growing concern that the debt crisis is morphing into a banking crisis. As doubts linger about the ability of some European lenders to withstand a Greek default and its ripple effects, the cost of insuring their debt rose to records, while a measure of their reluctance to lend to each other climbed to a 2 1/2-year high.

Germany may be getting ready to give up on Greece.

After almost two years of fighting to contain the region’s debt crisis and providing the biggest share of three European bailouts, Chancellor Angela Merkel is laying the ground for what markets say is almost a sure thing: a Greek default.

“It feels like Germany is preparing itself for a debt default,” Jacques Cailloux, chief European economist at Royal Bank of Scotland Group Plc in London, said in an interview. “Fatigue is setting in. Germany could be a first mover or other countries could be preparing too.”

Officials in Merkel’s government are debating how to shore up German banks in the event that Greece fails to meet the budget-cutting terms of its aid package and is unable to get a bailout-loan payment, three coalition officials said Sept. 9. The move capped a week of escalating German threats that Greece won’t get the money unless it meets fiscal targets and investors raising bets on a default.

Ring-fencing their banks and a hardening of rescue terms risk isolating Germany and unnerving global policy makers already fretting that the region’s political tussles are roiling markets and threatening growth. Underscoring the tone of weekend talks of Group of Seven finance chiefs, U.S. Treasury Secretary Timothy F. Geithner told Bloomberg Television that European authorities must “demonstrate they have enough political will” to end the crisis.

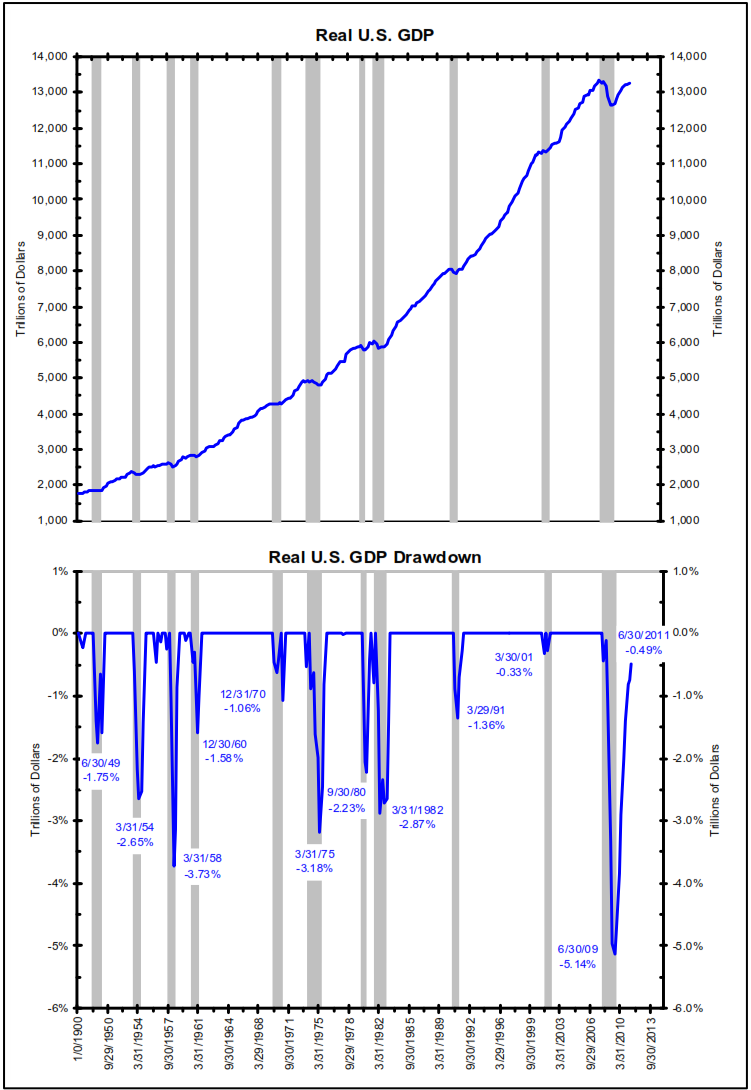

In the past we have noted that Martin Feldstein, one of the members of the business cycle dating committee, was the holdout in calling the end of the Great Recession. The committee works by consensus and Feldstein was not sure that the current economic expansion would make a new high. He relented and the Great Recession’s end was dated June 2009. The official call was made on September 20, 2010. For the moment, it looks like his first instincts were partially correct as a case can be made that the Great Recession never really ended.

The NBER has dated every recession back to 1854. A recession is a peak to trough in economic activity where the expansion off the trough results in a new high in real economic activity. This has been the case in every recession/depression/panic ever dated. Even the 1937 peak in economic activity (which began the 1937 recession) was above the 1929 peak (which started the Great Depression).

As the chart to the right shows, real GDP had its biggest fall since the end of WW2 (see the lower panel highlighting the drawdowns). More importantly, real GDP has made a new high in economic activity. If the economy continues to falter, then this is not a “double dip” but rather a continuation of the Great Recession. Now to be clear, the ultimate trough most likely already occurred in June 2009, which is how recessions are dated (peak to trough). However, the recession does not truly end until economic activity makes a new peak. For the moment, that has not happened. One could argue that August 2011 is the 44thmonth since the Great Recession began (December 2007). Only the Great Depression (which lasted 43 months from August 1929 to March 1933) and the Panic of 1873 (65 months from October 1873 to March 1879) took longer to make a new peak in economic activity.