Today’s Markets

- In Asia, Japan -0.3% to 9597. Hong Kong -0.5% to 21759. China +1.4% to 2688. India +1.0% to 17727.

- In Europe, at midday, London -1.0%. Paris -1.5%. Frankfurt -1.1%.

- Futures at 7:00: Dow -0.4%. S&P -0.6%. Nasdaq -0.5%. Crude -2.25% to $93.26. Gold -0.8% to $1540.70.

Thursday’s Economic Calendar

- 8:30 Initial Jobless Claims

8:30 Chicago Fed National Activity Index

10:00 New Home Sales

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

7:00 PM Conference: State Budgets Under Stress

European Central Bank President Jean-Claude Trichet said risk signals for financial stability in the euro area are flashing “red” as the debt crisis threatens to infect banks.

“On a personal basis I would say ‘yes, it is red’,” Trichet said late yesterday in Frankfurt after a meeting of the European Systemic Risk Board, referring to the group’s planned “dashboard” to monitor risks. “The message of the board is that” the link between debt problems and banks “is the most serious threat to financial stability in the European Union.”

The S&P 500 finished the day down 0.65%. The index was unfazed by the 12:30 reading of the FOMC minutes, but the afternoon slide coincided with Fed Chairman Bernanke’s press conference at 2:15. The index is now up 2.35% year-to-date but down 5.61% from the interim high set on April 29. From an intermediate perspective, the index is 90.3% above the March 2009 closing low and 17.8% below the nominal all-time high of October 2007

The emerging-market initial public offering boom, predicted for Brazil, Russia and India, is fizzling as inflation sends interest rates up, share prices down and prompts companies to scale back or cancel sales.

While Brazil’s stock exchange chief, Russia’s biggest underwriter and India’s government projected IPOs would rise threefold this year to $64 billion, issues are falling. Brazil dropped 29 percent from the year before to $2.7 billion and India sank 74 percent to $753 million, the least for the period for both since 2009, data compiled by bourses and Bloomberg show. Russia rose 16 percent to $3.3 billion and China slid 4.3 percent to $32 billion.

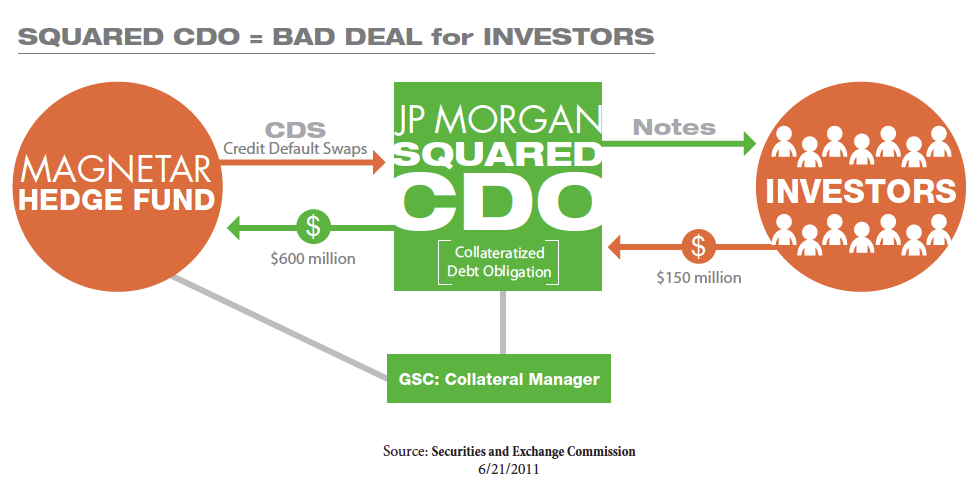

The SEC announced that JP Morgan has agreed to pay $153.6 million to settle charges related to a $1.1 billion heavily synthetic CDO called Squared which JP Morgan placed in early 2007 and was managed by GSC Partners, a now defunct CDO manager. The SEC has a cute but not all that helpful visual on the site, save it reflects the role of Magnetar as the moving force behind the deal.

Per the SEC’s complaint against JP Morgan, Magnetar provided $8.9 million in equity and shorted $600 million notional, or more than half the face amount of the CDO (this is consistent with our analysis, which had suggested that Magnetar, unlike Paulson, did not take down the full short side of its deals, since it like staying cash flow positive on its investments. The size of its short position was limited by the cash to be thrown off by the equity tranche). And needless to say, this was a CDO squared, meaning a CDO made heavily of junior tranches of other CDOs, so it was a colossally bad deal.

The complaints (one against JP Morgan and the other against GSC employee Edward Steffelin) make clear that the SEC had gotten its hands on some pretty damning e-mails. The core of the allegation against JPM was that all the marketing materials represented that the assets in the CDO were selected by GSC when they were in fact to a significant degree chosen by Magnetar.

Apple (AAPL) briefly traded back above its 200-day moving average today (Wednesday), but it has since reversed and is now closing right near its intraday low. The stock is down by nearly 12% since its peak on 2/17 and more than 7% this month alone.

Moody’s reported that the Moody’s/REAL All Property Type Aggregate Index declined 3.7% in April. Note: Moody’s CRE price index is a repeat sales index like Case-Shiller – but there are far fewer commercial sales and there are a large percentage of distressed sales – and that can impact prices and make the index very volatile.

The Moody’s/REAL Commercial Property Price Index dropped 3.7 percent from March and 13 percent from a year earlier. It’s now 49 percent below the peak of October 2007 and at its lowest point in data going back to December 2000 …

“In a case of the strong getting stronger and the weak getting weaker, major asset/major market prices have recovered more than half of their post-peak losses, while prices for distressed transactions continue to bounce around the bottom,” Moody’s said in the report.

Bonus: Don’t Drink the Deep Fried Kool-Aid